(September 2025 Blog) Property market momentum builds as investors eye Melbourne’s future gains

Australia’s property market is entering an important phase, with three cash rate cuts this year improving buyer confidence, boosting borrowing power and putting housing firmly back on the agenda for investors.

Sellers are also enjoying strong profits, and new forecasts point to Melbourne leading the nation’s growth in 2026.

All of this is shaping a market that feels more active, especially for investors planning their next move.

Rate cuts drive confidence and competition

This renewed activity is being fuelled by the Reserve Bank of Australia’s latest cash rate cut in August to 3.6%, which immediately began boosting confidence and competition across the housing market.

According to PropTrack senior economist Anne Flaherty, lower borrowing costs have historically driven faster price growth, with February’s cut sparking the highest number of buyer searches in three years.

That shift is already visible, with Domain reporting that all eight capitals recorded simultaneous house price growth last quarter, pushing the national median to $1.2 million. And with economists expecting further cuts before year’s end, stronger demand could add even more pace to the market.

Although affordability challenges persist, the mix of cheaper finance, healthier household budgets and rising sentiment is setting the stage for a highly competitive spring selling season.

Profit-making resales at record highs

Even before the latest cut, sellers were already recording strong results, with Domain’s Profit and Loss Report showing that almost all resales proved profitable in the first half of 2025.

Nationally, 97% of house resales and 88% of unit resales returned a profit – the highest levels in nearly two decades for houses and three years for units. Brisbane and Perth led the way with more than 99% of houses selling above purchase price, while Sydney sellers achieved the biggest dollar gains with a median profit of $700,500.

Regionally, units outperformed capital cities, with 95.7% of resales profitable.

Domain senior economist Joel Bowman said the results reflected longer holding periods and renewed momentum, with the outlook for further equity growth remaining positive.

Investors step back in front

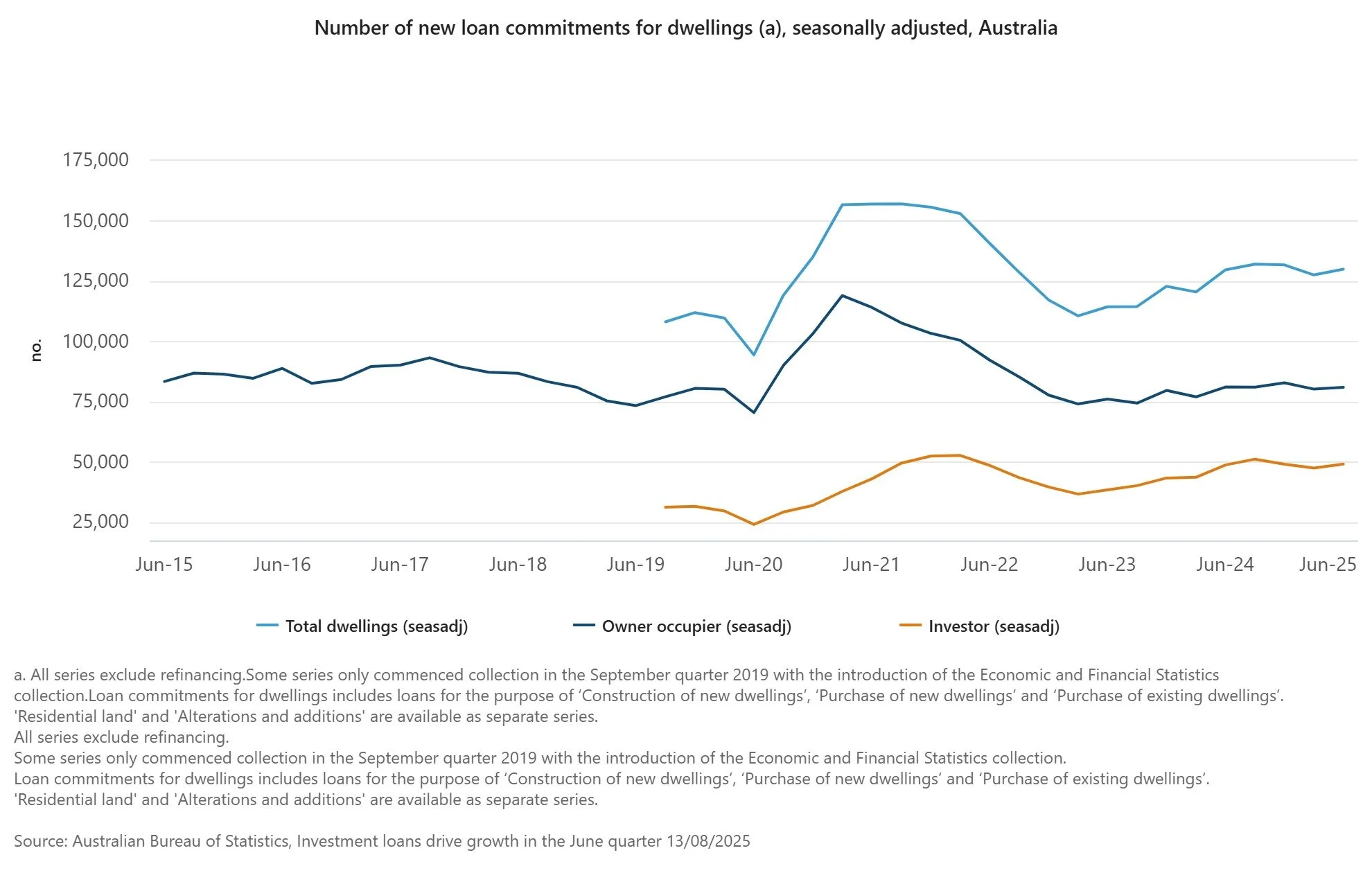

With resale profits at record highs and equity growth expected to continue, it’s no surprise that investors have been quick to re-enter the market. Australian Bureau of Statistics figures show investment loans increased 3.5% quarterly in the three months to June, compared with a 0.9% lift for owner-occupiers.

AMP chief economist Shane Oliver said affordability challenges weighed more heavily on first home buyers, while investors benefited from negative gearing and often focused on lower-priced properties or units.

Housing Industry Association chief economist Tim Reardon explained that investors typically led the early stages of an upturn, returning to the market sooner as they tended to be less risk-averse.

“We are in the middle of that cycle at present. Investors have been returning to the market, increasingly confident that ongoing strong population growth, tight labour markets and recovering household incomes will see the supply of homes outpaced by demand,” he told the Australian Financial Review.

With auction clearance rates above 70% and loan pre-approvals increasing, confidence among investors is undoubtedly strengthening.

Melbourne set to outpace other capitals in 2026

Looking ahead, Melbourne is tipped to deliver the strongest growth of any capital city, with KPMG forecasting that house prices will rise 6.6% in 2026. This will add almost $65,000 to the city’s current median of $983,000.

Unit values are predicted to climb even faster, up 7.1% or more than $43,000.

KPMG chief economist Dr Brendan Rynne said Melbourne was “on the verge of coming out of its post-Covid slumber”, with affordability in the unit market a key driver.

Local advocates are already seeing increased demand from buyers seeking to act before prices accelerate, while interstate investors are diversifying from Perth into Melbourne.

With national growth moderating in other cities, Melbourne’s recovery is expected to stand out, positioning it as a prime focus for investors planning ahead.

As an expert buyers agency, A Game Property Advisory can help you secure a quality property at a great price. Get in touch with Jim by calling 0422 446 170 or emailing jim@agameadvisory.com.au.